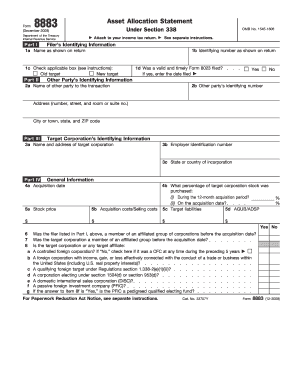

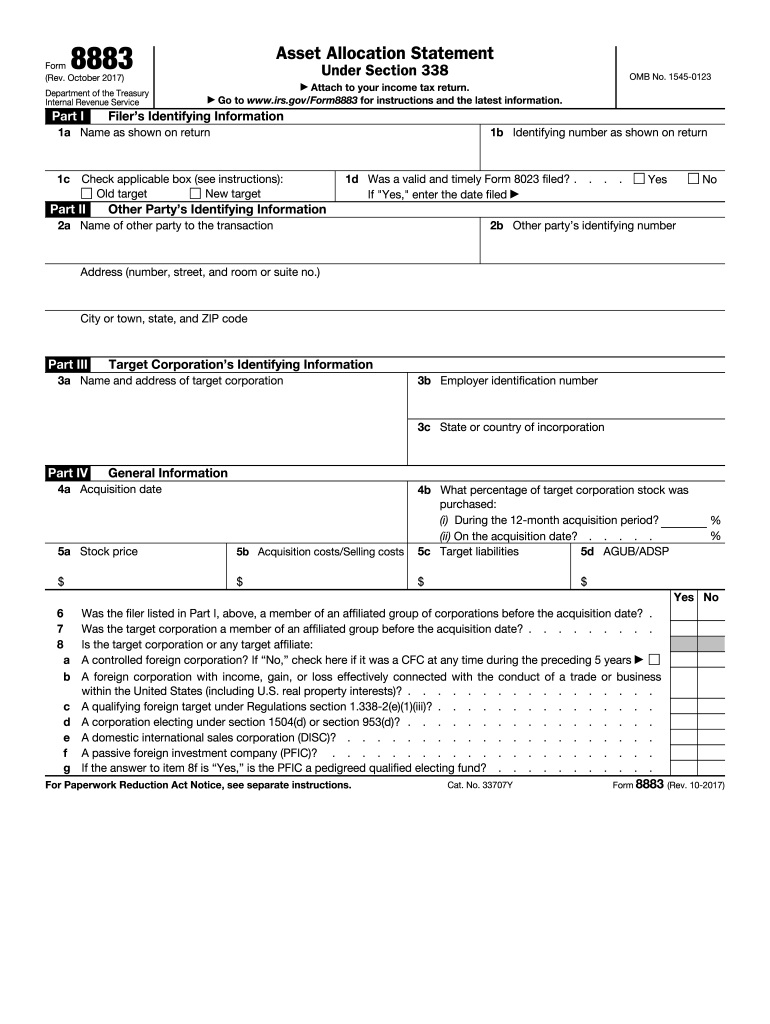

IRS 8883 2017-2026 free printable template

Instructions and Help about IRS 8883

How to edit IRS 8883

How to fill out IRS 8883

Latest updates to IRS 8883

All You Need to Know About IRS 8883

What is IRS 8883?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8883

What should I do if I realize I made an error on my filed IRS 8883?

If you discover a mistake on your IRS 8883 after submission, you should file an amended form as soon as possible. An amendment helps ensure the accuracy of your tax records and compliance with IRS regulations. Additionally, keep thorough documentation of any changes made for your records.

How can I track the status of my IRS 8883 submission?

To track the status of your IRS 8883, you can use the IRS online tracking tools available on their website. This allows you to verify receipt and processing status. In case of issues, be aware of common e-file rejection codes and how to address them to ensure a smooth filing experience.

Are there specific privacy measures I should consider when submitting an IRS 8883?

Yes, when submitting your IRS 8883, ensure that you are using secure methods such as encrypted email or secure online portals. Maintaining privacy and data security is crucial for protecting sensitive information included in the form. Follow IRS guidelines regarding data protection to enhance your security.

What if I need to file IRS 8883 on behalf of someone else?

If you are filing the IRS 8883 on behalf of someone else, ensure you have the appropriate Power of Attorney (POA) documentation. This allows you to represent the individual legally and handle their tax matters. Familiarize yourself with specific requirements for authorized representatives to avoid complications during the filing process.

What should I do if my IRS 8883 submission is rejected?

If your IRS 8883 submission is rejected, carefully review the rejection notice for details and common error codes. Address the identified issues and re-submit your form. If you're unsure about the reasons for rejection, consider consulting a tax professional for guidance on how to resolve the issues effectively.